Create A Monthly Budget To Figure Out How Much House You Can Afford And How Much To Put Down

By Kurt Real Estate Nov 23, 2019

Buying a home is one of the biggest decision and largest investments that anyone will ever make in their life. Needless to say, it’s not a decision that should be taken lightly.

Now don’t get me wrong. Home shopping is a lot of fun. I mean, there’s a reason why all those home buying and renovation shows are among the most popular on television. Everyone loves to picture themselves in their own little slice of the American dream, and everyone loves to take a blank slate and turn a house into their very own dream home.

However, in order to make the process as fun, enjoyable, and as stress-free as possible, it’s important that every home buyer has a clear understanding of what they can comfortably afford.

Not only will this eliminate any doubt as to what their maximum price should be, but it will also set them on a path to enjoying their new life as a home owner as much as possible. The joy and satisfaction of buying a new home can quickly dissipate if the proper financial steps aren’t taken ahead of time.

That’s why every home buyer should have a clearly-defined, written, monthly budget that outlines all their income and expenses. Sound a little daunting or you’re not sure where to start?

Then you’ve come to the right place. Let me show you just how quick and easy it can be to create a written budget in no time.

Download A Budget Planning App

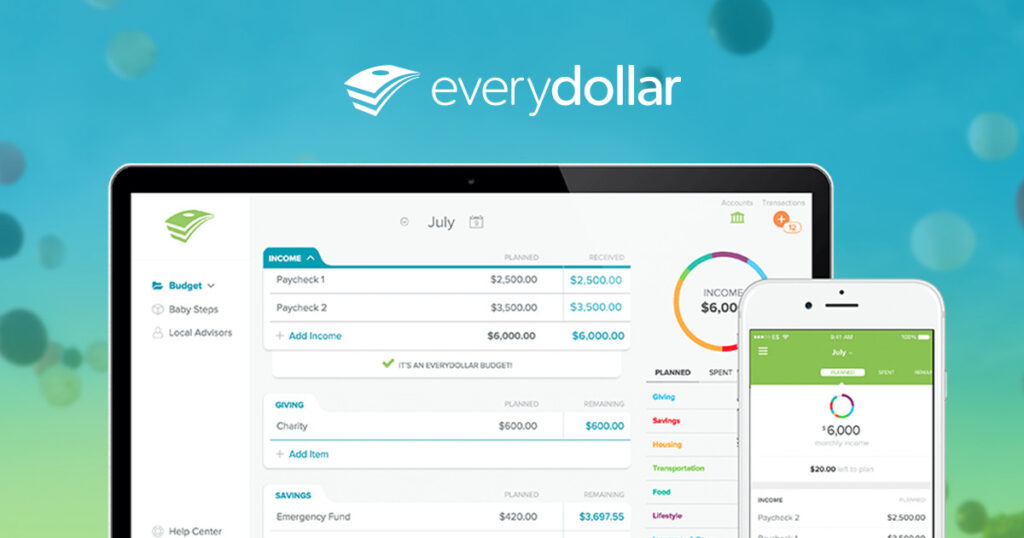

If you’re creating your written budget from scratch, I highly recommend downloading a free budgeting app such as Mint or EveryDollar. I personally use EveryDollar, and can attest to how easy and simple it is to use.

After you’ve created an account, the app will walk you through setting up and inputting your various expense categories such as housing, transportation, savings, food, lifestyle, charitable giving, and income. This may take a little bit of time, but probably no more than an hour.

Estimate An Affordable Monthly Mortgage Payment Using A Mortgage Calculator

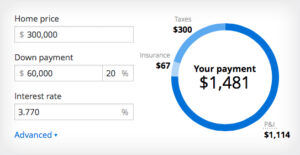

After you’ve created your first budget, you’ll need to figure out what kind of mortgage payment you can comfortably afford. To do that, you can download a free mortgage calculator app or search for one online.

Before you start crunching numbers, a general rule of thumb is that your mortgage payment should not exceed more than 33% of your take home pay. Given the high cost of living in Orange County, that can be somewhat difficult, so you’ll just have to use your best judgement. But having a written budget will make this judgment call a lot easier for you.

Now that you’ve got an idea of what kind of monthly payment you can afford, you can start working the numbers in your budget app.

such as the interest rate, taxes, and HOA dues will vary depending on the property. For property taxes in Orange County, you can estimate an average of 1.25%. HOA dues, if any, will change from property to property, so estimate on the high side of $350-$400/month. Interest rates will also vary depending on the type of loan you’re getting, your financials, credit score, and your down payment. But as I write this, the prevailing rates seem to be around 4% for qualified buyers.

*Side note* – If you’ve been unsure about how much of a down payment you’ll need to afford a house, this exercise should clearly answer that question for you.

Plug Some Numbers Into Your Budget And Make Any Necessary Adjustments

After playing around with some mortgage amounts, plug those numbers into your budget and see what makes sense for you. If you’re having trouble making the numbers work out, see what you can cut in other budget categories to put towards your new house. If you’re still having trouble coming up with a comfortable mortgage amount, you may need to save up more of a down payment. But at least you’ll have a clear understanding of what makes sense and what doesn’t.

Conclusion

Owning a home can be one of the most personally and financially rewarding things you’ll ever do. With a little bit of planning up front, you can have total peace of mind of not just what you can afford today, but what your financial priorities are for the future.

If you have any questions, please don’t hesitate to reach out at any time. Let me know how I can help!

Join our network

Keep up to date with the latest market trends and opportunities in Orange County.